Infinite Finance focuses on sustainable development trends and the increasingly severe phenomenon of global warming while actively evaluating the possible risks and opportunities of climate change for enterprises. The Task Force on Climate-Related Financial Disclosures (TCFD) of the United Nations International Financial Stability Board (FSB) provides information related to climate change in four categories: governance, strategy, risk management, and indicators and targets. Infinite Finance has assessed possible impacts and developed response measures to enhance Infinite Finance’s resilience to climate change risks by identifying the risks and opportunities posed by climate change to the business.

Core Elements of the TCFD Main Categories

| Governance |

Strategy |

Risk Management |

Indicators and Targets |

| The Board of Directors is the highest supervisory authority on climate change. |

This should include all departments in the company to identify climate risk issues and opportunities that the company may face. |

This involves constructing Infinite Finance climate risk identification procedures using TCFD architecture. |

Monitoring greenhouse gas emissions annually to enhance energy and resource efficiency, and commissioning a greenhouse gas inventory project in 2024 as the basis for future energy-saving and carbon-reduction initiatives. |

| Governance includes climate change risk identification and management measures based on the annual sustainability report. Measures are submitted to the Board of Directors for approval by the Sustainable Development Committee. |

The operational, strategic, and financial implications of high-risk and high-opportunity issues that may have significant impact are assessed. |

Climate-related issues with high risk and opportunity are identified according to the impact degree and their likelihood of occurrence (short-, mid-, and long-term). |

Remote preparedness drills are conducted yearly to ensure that operations are not interrupted due to extreme weather disasters. |

| The Sustainable Development Committee's Risk Management Group is responsible for the climate change risk management system. |

Countermeasures and management measures are studied and developed. |

Climate change risks are integrated into overall climate management policies. |

Green finance and investments are being developed to gradually increase the proportion of related investment and financing. |

Climate Risk and Opportunity Issues

■ Significant Risks and Opportunities

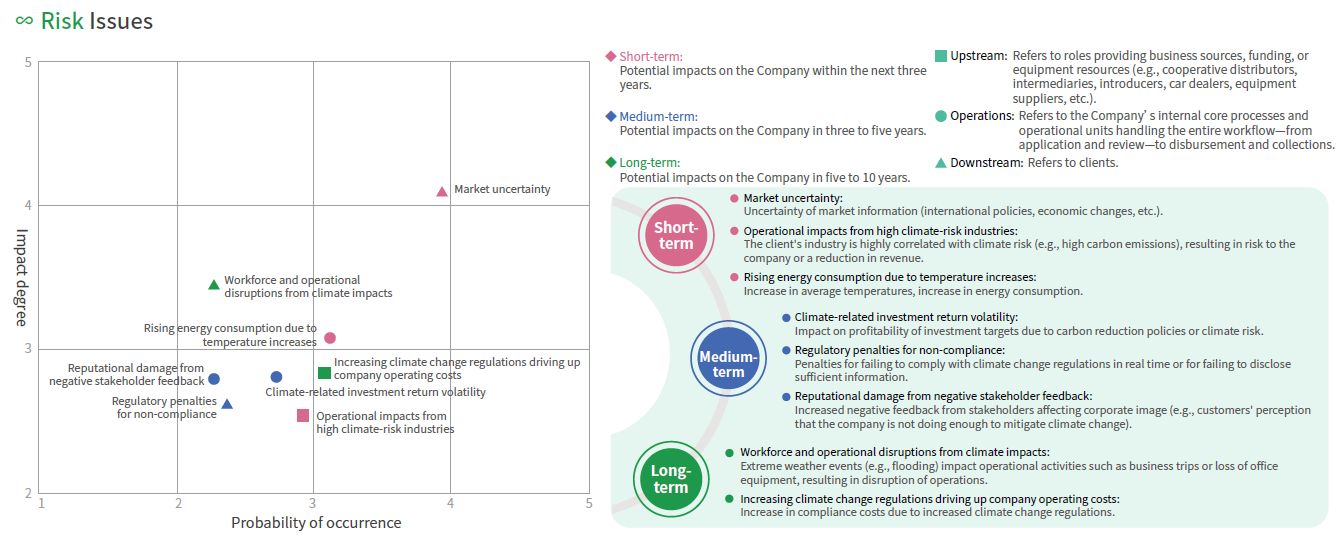

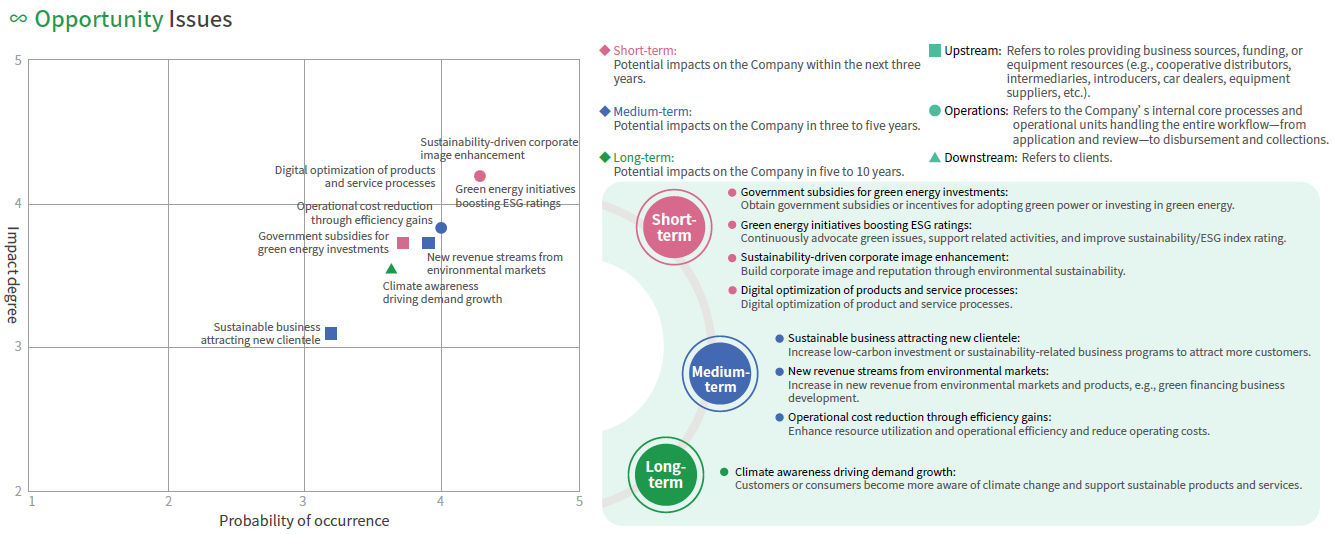

Infinite Finance uses the Task Force on Climate-related Financial Disclosures (TCFD) to examine industry trends for financial and leasing industries while aggregating eight climate change-related risks and eight opportunities. Internal executives at or above the director level have identified the relevance of each issue to its business one by one and assessed the possible impacts. As such, Infinite Finance's climate risk matrix and climate opportunity matrix were obtained. The top three major risk issues were determined to be(1) market uncertainty, (2) climate impact on workforce attendance and operations, and (3) increased energy consumption due to rising temperatures. The top three material opportunity issues are: (1) sustainable operations enhancing corporate image, (2) digital optimization of products and service processes, and (3) green energy initiatives improving ESG ratings.The short-, medium- and long-term risks of climate change that Infinite Finance faces were also summarized. However, climate change is a long-term global challenge. Long-term impacts may depend on several factors, including changes in policies and regulations, technological advances, market trends, and changes in social consciousness, among others. Infinite Finance focuses on the issues that have the greatest impact and likelihood of occurrence while outlining strategies and measures to address these issues.

Recent risk information related to the financial and leasing industries was collected to identify possible risk events. Infinite Finance has generated a climate change risk events matrix according to the impact degree of risks and their likelihood of occurrence:

■ Risk Issues

While climate change poses risks, it also creates potential business and development opportunities for Infinite Finance. Aimed at opportunity factors accompanying climate change, a climate change opportunity events matrix has been developed according to impact degree and probability of occurrence.

■ Opportunity Issues

Response to Significant Climate Change Risks and Opportunities

Based on a variety of climate change risks and opportunity factors, Infinite Finance has integrated three significant risks and three major opportunity issues according to their "impact/impact degree" and "likelihood of occurrence." It has further developed corresponding strategies and measures to reduce financial impacts and seize business opportunities brought about by climate change.

| Three Risk Issues |

Potential Impact on the Company's Operations |

Financial Impacts |

Risk Strategies and Management Measures |

| Market uncertainty |

The uncertainty of market information (international policies, economic changes, etc.) affects the overall operating situation of the company, requiring time to respond to different changes. |

Changes in market share increase operational costs and time. |

- Market trends and climate change are continuously monitored to adjust the business in realtime to provide products and services that meet customer needs.

- Participating in seminars to enhance the sensitivity and judgment of staff to market information through daily news; responding early and simulating the results of changes.

|

| Workforce and operational disruptions from climate impacts |

Increased extreme weather events, such as typhoons or floods, have an impact on business activities such as employee attendance and travel. |

Employees affected by a disaster with disrupted operations, including property and personnel losses. |

- Tracking climate change predictions through government and press releases while planning agency mechanisms to respond to changes.

- Rehearsal and test backup mechanisms are provided to avoid operational disruption and establish remote working systems and environments.

- Staff knowledge of health, safety, and disaster prevention is enhanced through seminars and activities.

|

| Rising energy consumption due to temperature increases |

The increase in average temperature leads to increased energy demand, |

AAsset damage and devaluation, higher energy consumption, and increased operational costs. |

- Evaluate climate-related risks in business activities and develop response strategies, such as diversification of operational locations and disaster emergency plans.

- Establish a risk assessment mechanism, with front-end business and review teams evaluating the extent of climate change impact on clients' industries to distinguish high-risk clients.

|

|

Three Opportunity Issues

|

Potential Impact on the Company's Operations |

Financial Impacts |

Opportunity Strategies and

Management Measures |

| Green energy initiatives boosting ESG ratings |

The company's sustainability/ESG index rating can be improved through continual positive advocacy and the promotion of green energy. |

Increased revenue and enhanced corporate reputation. |

- The concept of sustainability is actively advocated for and promoted through environmental protection, social responsibility, and corporate governance to reduce environmental damage.

- Organizing and participating in energy-saving and carbon reduction activities to increase the company's exposure and promote the company's ESG sustainable corporate image.

|

| Digital optimization of products and service processes |

- Digitalizing processes can automate many tedious tasks, increase work efficiency, and reduce energy consumption and waste.

- Introducing digital tools can effectively identify and manage credit and ESG-related risks.

|

Reduction in operating costs and energy consumption |

- Provide necessary technical training for employees and invest in technological solutions that support ESG goals, introducing new technologies for energy conservation and carbon reduction.

- Through digital optimization, regularly review and improve product or service processes to enhance efficiency.

|

| Sustainability-driven corporate image enhancement |

The company's good image and reputation promote an increase in demand for products and services. |

The company's scale is expanded, and revenue is increased. |

- Excellent talents are recruited to collaborate with other green enterprises, boosting the effect of sustainable operations.

- Infinite Finance has been built and developed into a sustainable enterprise through the promotion of ESG culture. This not only protects the environment and society but also enhances the company's image and reputation.

|